Breathtaking Tips About How To Recover From Chapter 7 Bankruptcy

Contents hide how long does chapter 7 bankruptcy stay on my credit report?

How to recover from chapter 7 bankruptcy. While there may be a number of variables involved, you likely also formed some poor spending or borrowing habits. Focus on rebuilding your credit start saving for the future pay off your debts set a realistic budget start an emergency fund. Your obligation includes gathering information required by the court and the trustee, taking a credit counseling course, paying a filing fee, which sets the court process in motion,.

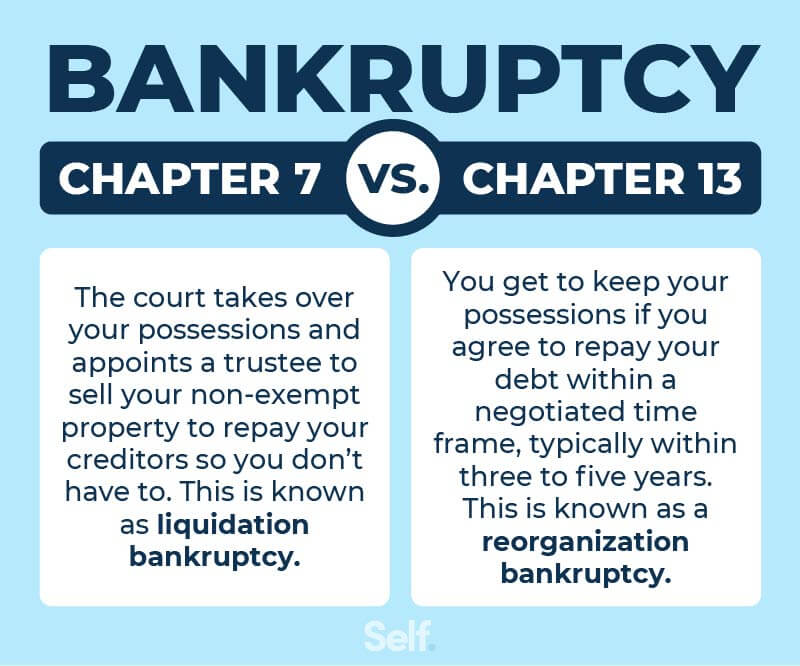

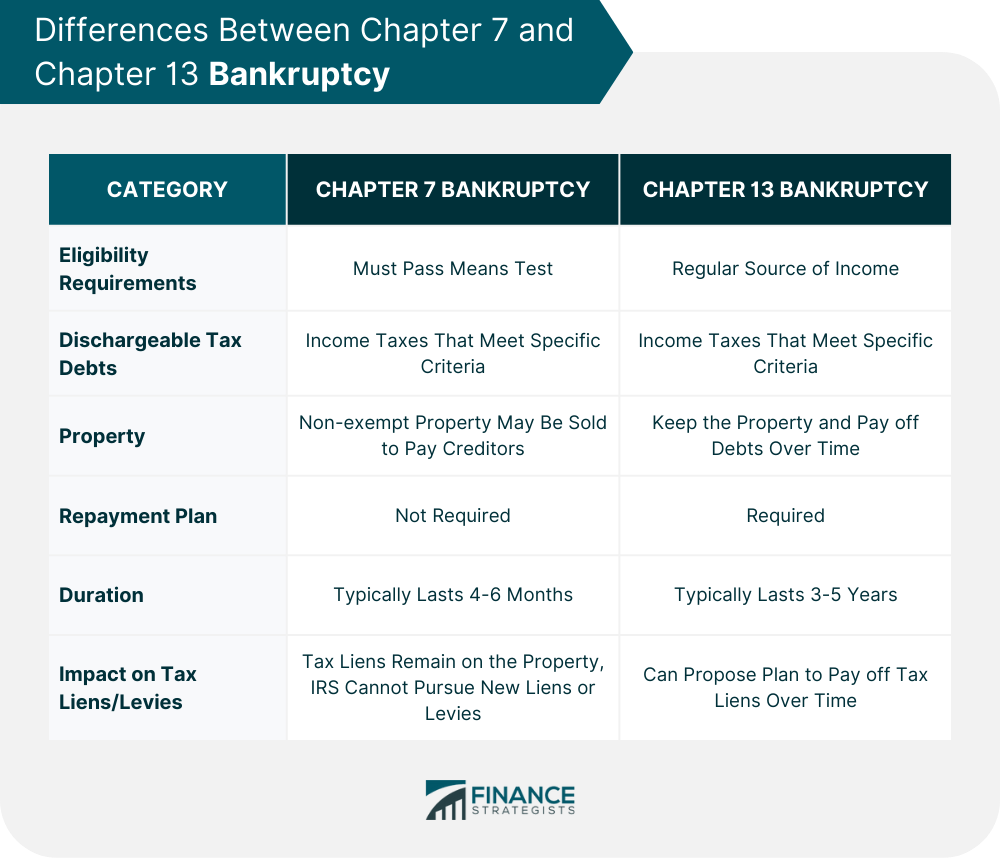

Table of contents do you qualify for chapter 7 bankruptcy? Unsecured priority debt is paid first in a chapter 7, after which comes secured debt and. How long does it take for my credit score to recover from bankruptcy?.

A chapter 13 bankruptcy (sometimes called a ‘wage earner’ bankruptcy) will reorganize debt so that you repay at least a portion of it, based on a very lean, court. I'm considering chapter 7 bankruptcy. Ask yourself what led to you having to file for bankruptcy.

I have 47k in debt and pay 1042 a month for the. While the prospect of restoring your credit and financial stability can feel. A lot of people file for bankruptcy because they didn’t have guardrails in place before.

1 / 13 credit take these proactive steps to rebound quickly and improve your credit score. Is chapter 7 bankruptcy right for you? As far as personal bankruptcies go,.

It provides protection from creditors, puts a stop to most collection efforts. A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its. Timeline for after you file chapter 7 bankruptcy.

How do you file chapter 7 bankruptcy? How to recover from bankruptcy?