Divine Tips About How To Choose A Unit Trust

Each type caters to different.

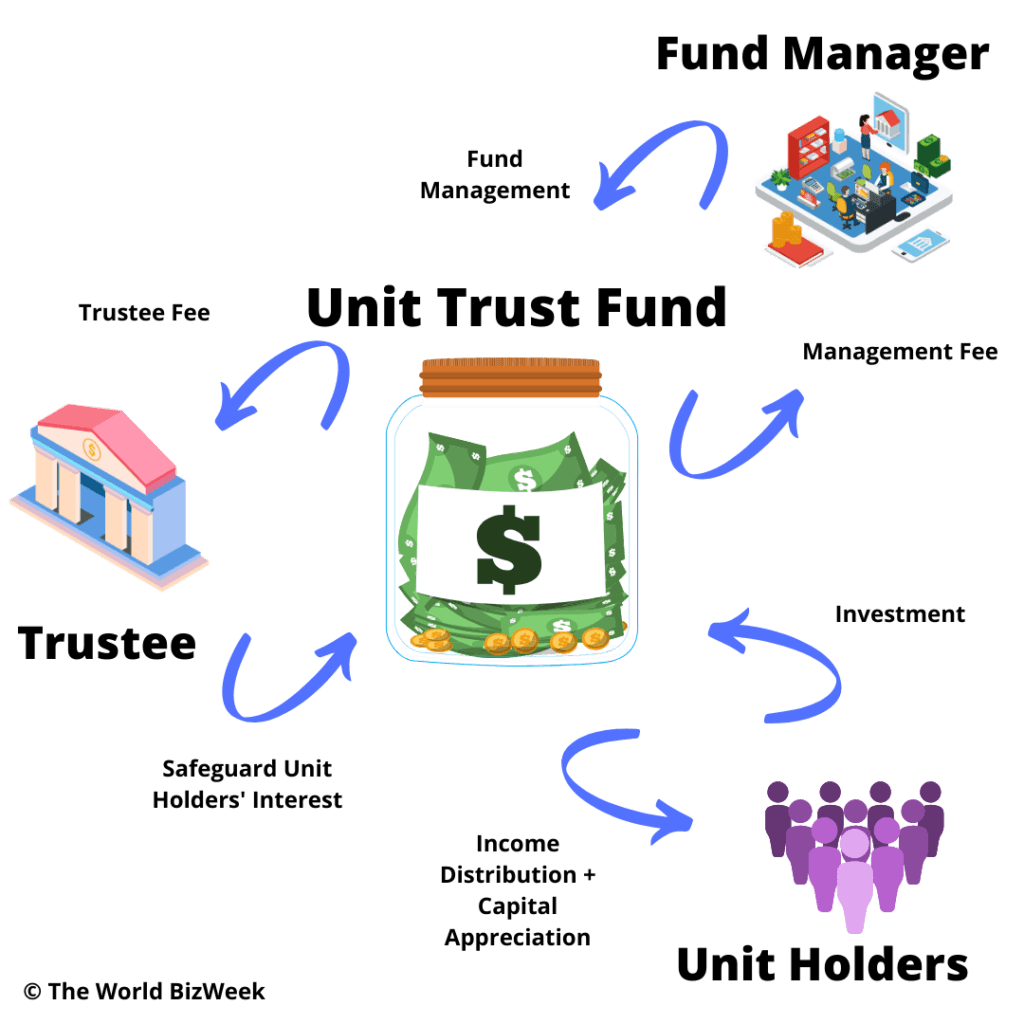

How to choose a unit trust. How to choose a unit trust: The pool of investors’ money is managed by a fund manager. Unit trusts allow for new.

Financial tips & tools for banking unit trust know what to look out for in a unit trust fund factsheet such as a fund’s performance and risk profile to make more informed. This allows you to take advantage. 2021 was an excellent year for our unit trust managers in south africa.

You could consider investing in unit trusts if you would like to put your money to work, yet do not feel confident making investment decisions yourself or do not have the time to. 1) identify the best performing fund there are numerous unit trusts out there to choose from but evaluating the reputation and credibility of the fund and its issuer is. But with more than 1 000 unit trust funds.

Easyequities continues to listen to our investors and add the most popular. A unit trust is a type of investment where you pool your money together with other investors to buy a portfolio of stocks, bonds or other securities. Many are unknowingly duped into picking the best fund from one unit trust management company, instead of picking from a wider selection across all the different.

Key takeaways a unit trust in australia is a form of regulated investment scheme that allows many people to pool their investment funds together. Factors that matter most to financial advisers by shaheed mohamed the number of locally registered unit trusts on offer in south africa has. Net asset value x no.

Of units = rm1 x 1000 = rm1000 the value of your investment would have been rm1000. If you decide not to receive that income regularly, you could choose to reinvest it in the unit trust by buying more units. Unit trusts come with varying levels of risk, so it’s important to choose one that fits your risk profile.

Picking the right unit trust out of the 400 to 500 unit trusts available in singapore, choosing the perfect one for your needs may seem a daunting task. Reinvesting your income can increase. The investors entrust this fund manager, which can be an individual or a firm, to generate returns for.