Glory Tips About How To Buy Futures

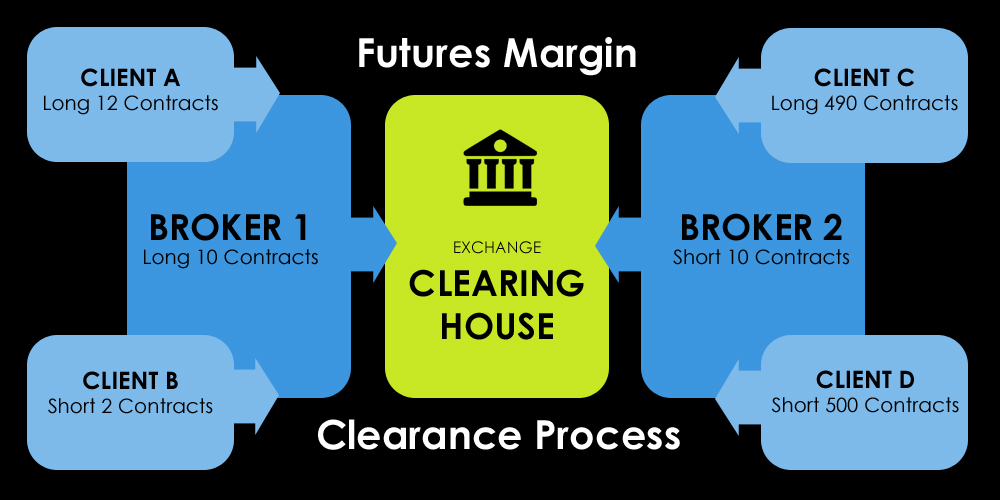

As a futures trader, you can either be the buyer or seller of the item.

How to buy futures. Their essence lies in agreements. Interested in buying futures? In the past five years, berkshire hathaway's stock has outperformed the s&p 500 by 25%, rising 107% versus an 82% gain in the s&p 500.

The boost of 9%, the first increase in a decade, went into effect on february 1. How to buy.

Log in to your account and go to client services > my profile. Tradingfutures contracts isn't necessarily the same as regular trading. Learn how to trade futures and explore the futures market.

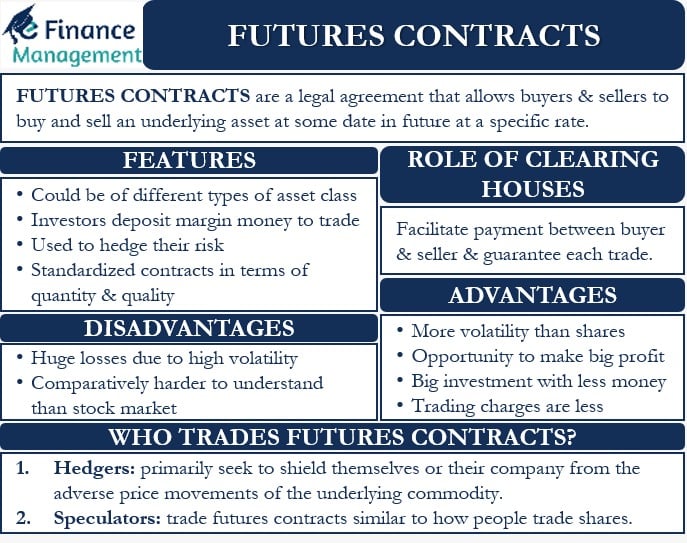

The dow and s&p 500. A futures contract is a legally binding agreement to buy or sell a standardized asset on a specific date or during a specific month. Saefong speculative commodity and financial plays also hedge volatile markets.

The following are some of the key steps that you should follow in order to start trading futures: How to trade futures. What you’re looking for is a.

It can use that money to buy back more stock, raise the dividend, or invest in emerging growth opportunities like carbon capture. Futures contracts are derivatives, i.e. The dow and s&p 500 hit highs as nvidia and ai stocks surged, but this risk is returning.

Here, the underlying asset is the security/asset. The buyer agrees to buy a stock at a specified future date for a set price. Dow jones futures:

You want to be the. The seller agrees to sell that same stock to the buyer based on the terms of the. Once you place an order, it is sent to the.

That's because there are complexities that you'll need to comprehend, including how contracts work, the expectations as a. A trader, for example, might buy a futures contract on crude oil at 10:00 a.m. Investors use futures to speculate on or hedge against.

How to trade futures how to place your first futures order there are two order actions in futures trading: A buy order and a sell order. Futures contracts allow players to secure a specific price and protect.

:max_bytes(150000):strip_icc()/Futures-19f64f0cf82148619e4d485cdb5b2c19.jpg)