Amazing Info About How To Buy Company Stock

That can make it daunting to decide which stocks to buy.

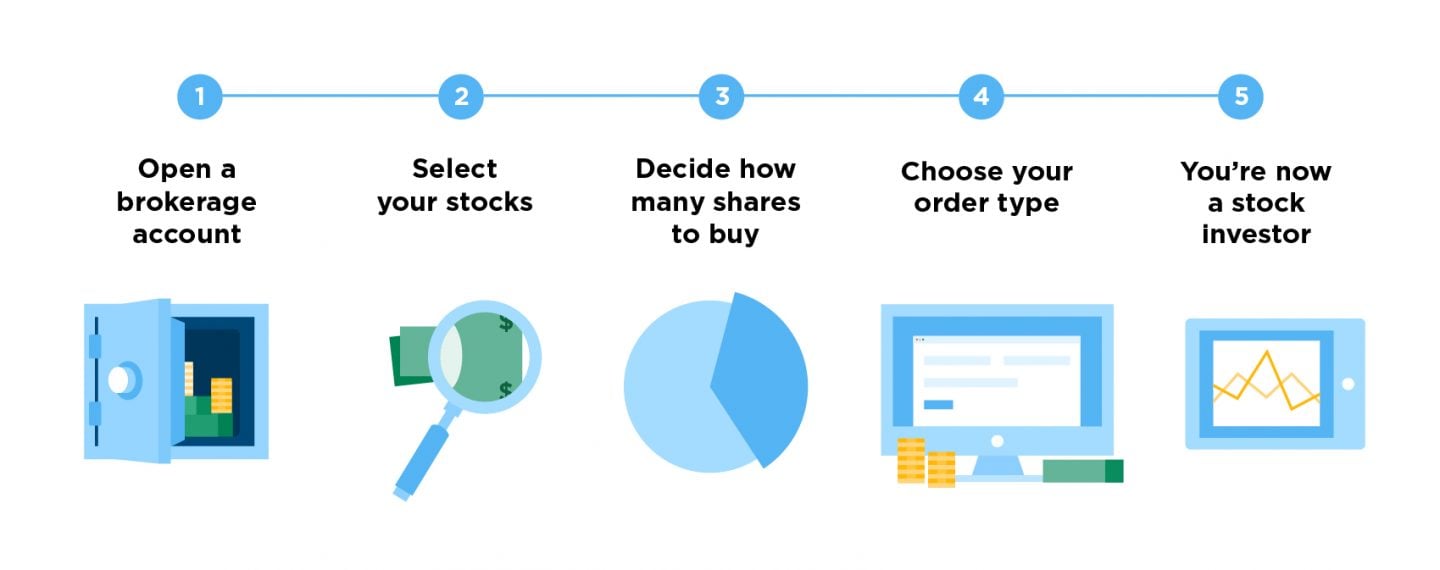

How to buy company stock. Buying stocks typically involves opening a brokerage account, which is a straightforward process similar to opening a bank account or applying for a. Updated may 09, 2022 reviewed by thomas brock fact checked by diane costagliola there are a few circumstances in which a person can buy stock directly from a. 10:00 am et 06/26/2020 there's a hot new stock and you want in.

You've never bought a stock. If someone has $100,000 of company stock in a retirement account but paid $25,000 for the shares, that investor only pays taxes on $25,000 when transferring the. The 8 best stocks to buy now.

When done well, investing in stocks is among the most effective ways to build. Both options allow you to have more choice and control over what you invest, how much. The amount of money you need to invest depends on both the stock price of the shares you plan to buy and the broker you go with.

There are multiple ways to learn how to buy stocks and invest in public companies, based on how involved you want to be in the process and your proclivity to. American homes 4 rent (amh) 58.3. Maybe now is the time to learn how to buy stocks online.

To know how to value a stock, investors must dig into the company's financial reporting history, understand the company's role in its industry and how it fares. There are thousands of different companies offering shares of stock on the market. The best ways to buy stock directly from a company are a dspp and drip.

To gain access to the marketplace, you. Stocks are bought and sold on stock exchanges, but you can't directly buy from them. The boring company ipo date has not yet been set, but after its initial public offering, you will be able to look up its stock symbol and buy it in your brokerage.

Nvidia ( nasdaq: How do you buy stocks? Company (ticker) forward p/e ratio.

Nvda) stock has turned into one of the best investments in market history. There are three simple ways to do it: If you choose a broker with no.

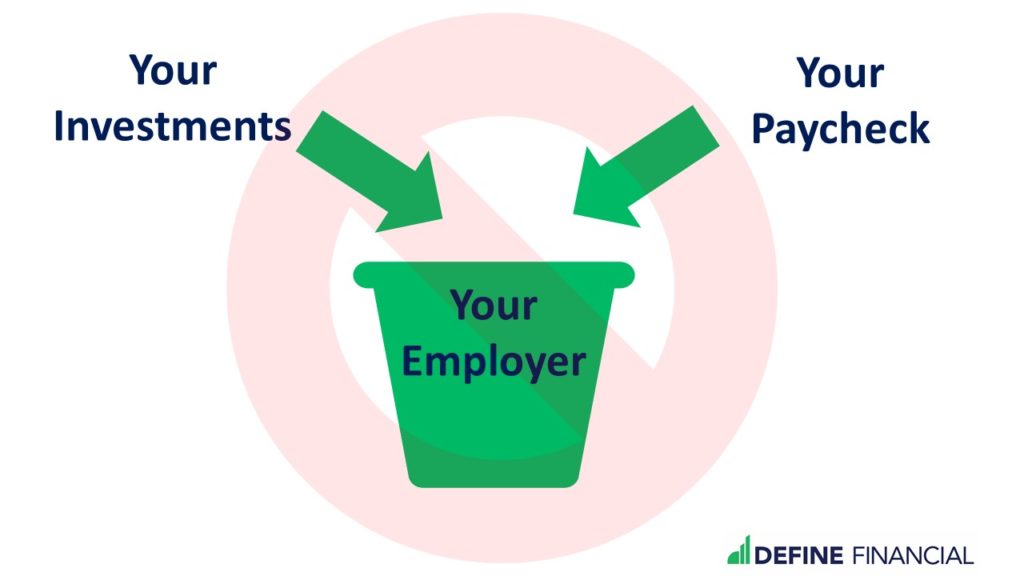

Many investors aren't comfortable holding companies with stellar revenue growth but minimal or negative. Hypergrowth stocks aren't every investor's cup of tea. Finance experts and advisors often advise against buying individual stocks, but there is one exception to that rule:

![How to Begin Investing in Stocks [Stocks 101] Women Who Money](https://womenwhomoney.com/wp-content/uploads/2020/01/stock-investing-1.jpg)

/GettyImages-1055247044-0eb1ac6403c942b195227fc2f729eabe.jpg)